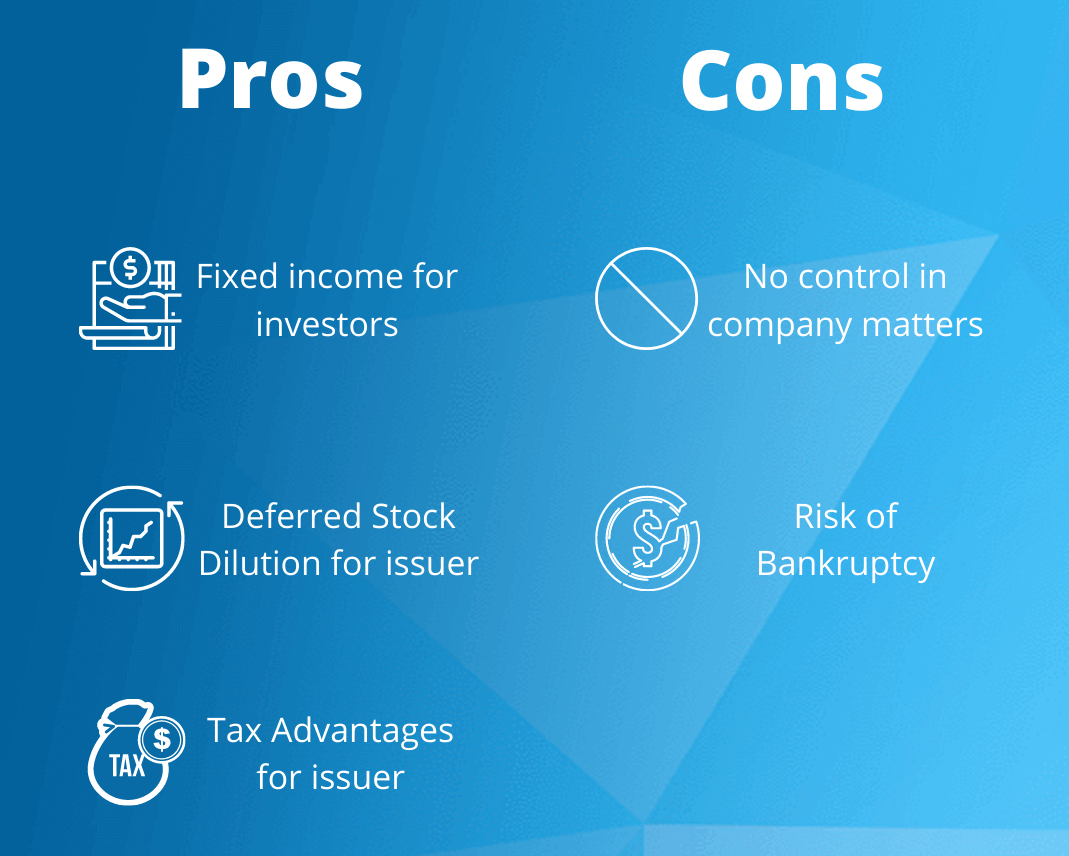

Convertible Bonds Advantages and Disadvantages

19 Major Advantages and Disadvantages of Annuities. A high-yield bond is a high paying bond with a lower credit rating than investment-grade corporate bonds Treasury bonds and municipal bonds.

Convertible Bond Everything You Need To Know Eqvista

If bonds are sold on the public market they can be traded - similar to shares.

. It is used by investors to predict future value. It is also known as a straight bond or a bullet bond. It is one of the two primary sources of return on his investment.

Another form of preferred stock is called a convertible share. 17 Key Advantages and Disadvantages of Corporate Bonds. An investor is entitled to receive a dividend from the company.

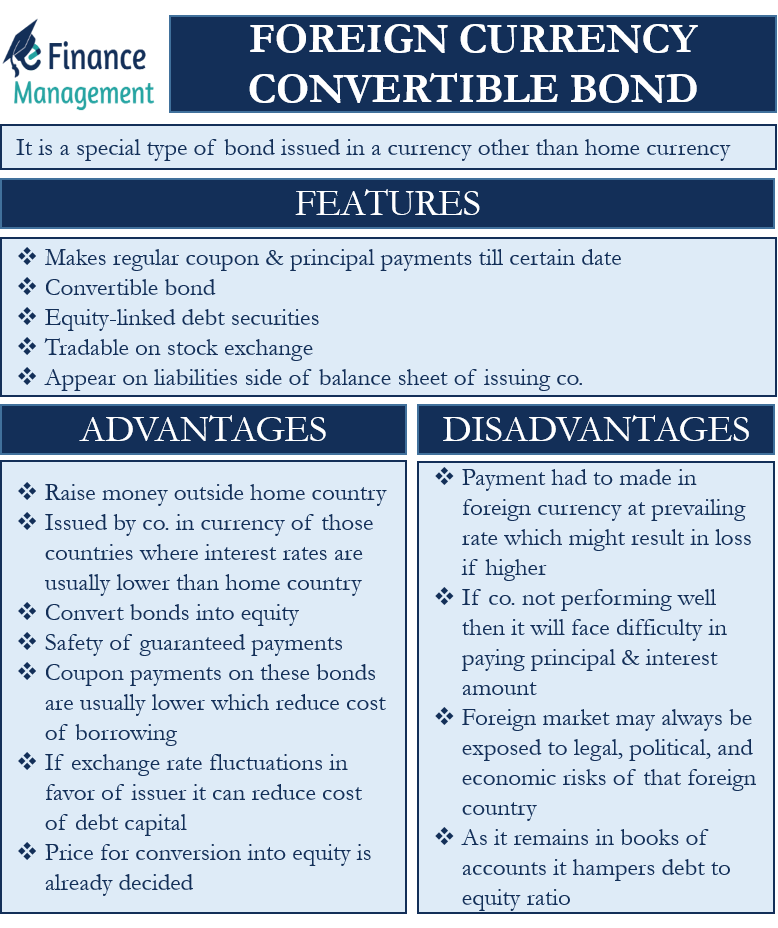

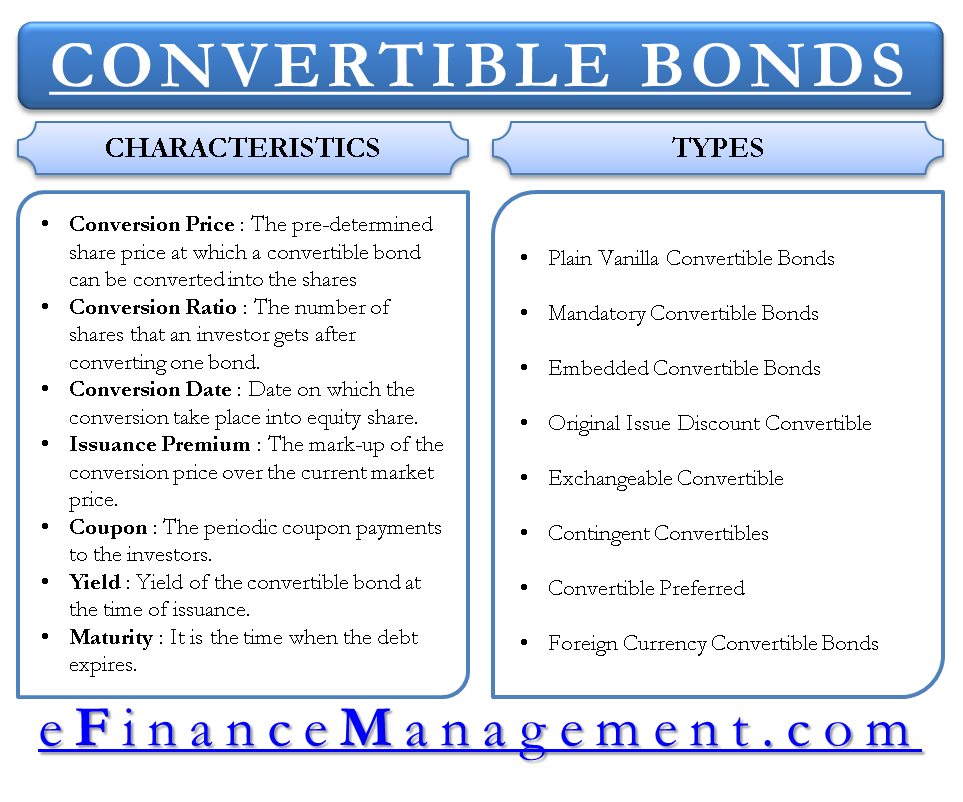

Advantages and Disadvantages of Investment in Equity Share Capital Advantages Dividend. A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of goldThe gold standard was the basis for the international monetary system from the 1870s to the early 1920s and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold. Some corporate bonds are structured to be convertible which means they can be exchanged for shares at some point in the future.

United States The conglomerate fad of the 1960s. Types of Financial Instruments. These preferred stock advantages and disadvantages are worth reviewing if youre in the market to expand your.

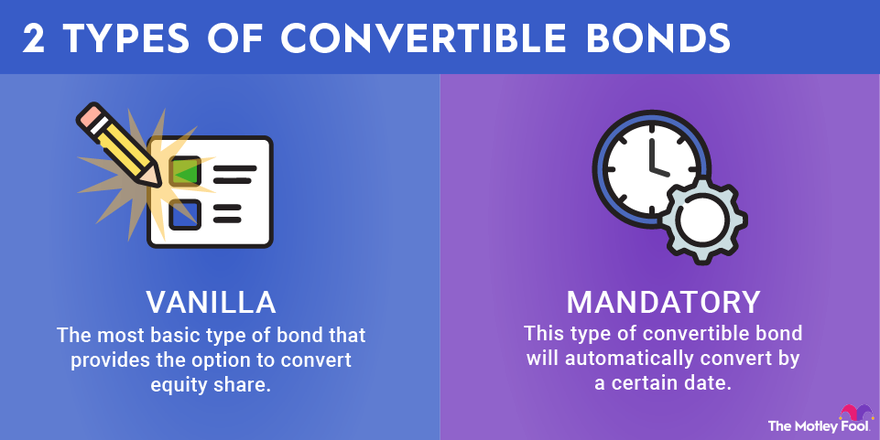

The other source of return on investment apart from dividends is capital gains. Advantages of Preference Shares Owners of preference shares receive fixed dividends well before common shareholders see any money. Different Types of Bonds Plain Vanilla Bonds.

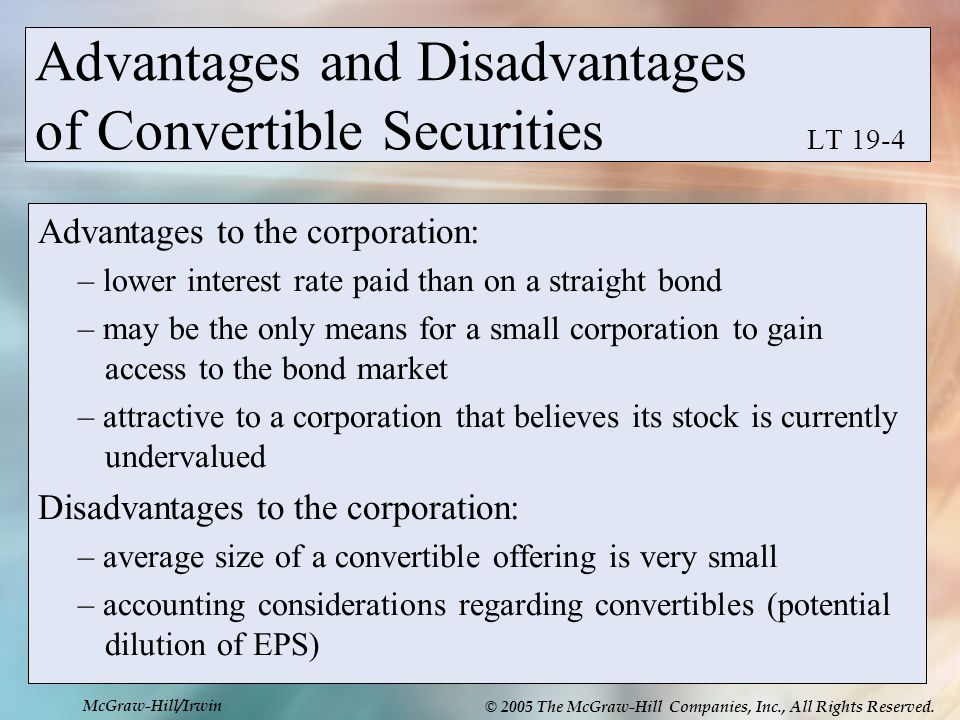

Cash and cash equivalents are those items which are recorded in the balance sheet of the company and refers to the value of the assets of the company which are held in cash or can be easily convertible to cash ie. Definition of Cash and Cash Equivalents. The financing of the company by way of issuance convertible bonds must be apprehended in the light of its advantages and disadvantages before making the decision as this would help the company to avoid the occurrence of subsequent difficulties associated with them.

It carries financial value and represents a binding agreement between two or more parties. During the 1960s the United States was caught up in a conglomerate fad which turned out to be a form of speculative mania. It is a document that represents an asset to one party and liability to another.

Examples of financial instruments are bills of. A plain vanilla bond is a bond without unusual features. For more information see advantages and disadvantages of raising finance through private placements.

Because of the higher risk of. Aquí nos gustaría mostrarte una descripción pero el sitio web que estás mirando no lo permite. A zero-coupon bond is a type of bond with no coupon.

It is one of the simplest forms of bond with a fixed coupon and a defined maturity and is usually issued and redeemed at face value. When convertible bonds are issued initially. Due to a combination of low interest rates and a repeating bear-bull market conglomerates were able to buy smaller companies in leveraged buyouts sometimes at temporarily deflated values.

Bank accounts and marketable securities like debt securities where the maturity date is less than 90 days treasury. A financial instrument is a financial contract between two parties. 17 Biggest Advantages and Disadvantages of.

Advantages of issuing corporate bonds. In either case dividends are only paid if the company turns a.

Convertible Bonds Primer Debt Conversion Features

Foreign Currency Convertible Bond Fccb

Convertible Securities Ppt Video Online Download

Convertible Bonds Efinancemanagement

Convertibles Warrants And Derivatives Ppt Video Online Download

Comments

Post a Comment